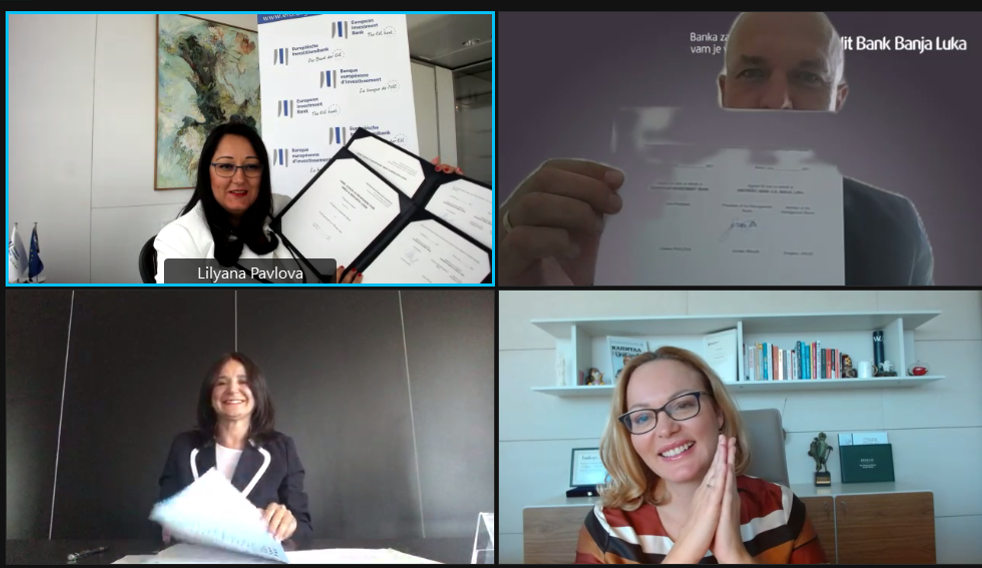

Team Europe: EIB to accelerate recovery of SMEs in Western Balkans with new loans signed with two UniCredit member banks

- The EIB has signed two loans with UniCredit in Serbia and Bosnia and Herzegovina totalling up to €100 million to boost support for small and medium-sized businesses for faster COVID-19 recovery.

- This investment contributes to the strengthening of the private sector, supporting jobs, liquidity and expansion of business operations.

- The new loans signed today bring the total amount of credit lines provided so far by the EIB for SMEs’ COVID-19 recovery under Team Europe’s financial support for the Western Balkans to €475 million.

The European Investment Bank (EIB) and UniCredit Bank Srbija A.D. (UCBS) have signed an agreement to provide up to €50 million for the financing of small and medium enterprises (SMEs) and Mid-Caps in Serbia to help them meet the challenge of recovering from the COVID-19 crisis. The loan will help companies to overcome the financial constraints brought about by the pandemic, maintaining liquidity and jobs. This is the fourth credit line provided so far by the EIB in support of Serbian companies under the Team Europe financial package for COVID-19 recovery in the Western Balkans. With the new loan signed today, the total EIB financing for COVID-19 recovery provided to Serbian SMEs since the start of the pandemic will reach €140 million.

UCBS will on-lend the funds to SMEs and mid-caps in Serbia affected by the COVID-19 crisis with more favourable and affordable conditions. The companies will be able to use the EIB funds to finance their liquidity, working capital and medium to long-term investment needs.

EIB Vice-President Lilyana Pavlova, who responsible for the Bank’s activities in Serbia, said: “The EIB continues to support Serbia’s growth and development with this significant investment signed today. We are dedicated to creating the conditions needed for a faster COVID-19 recovery and the transition of the Serbian economy towards a more resilient, green, sustainable model, able to compete successfully on the global markets. We are glad to have partners like UniCredit Bank that are able to extend our financial support directly to companies in Serbia, thus saving jobs and incomes for thousands of people.”

Teodora Petkova, Head of Eastern Europe at UniCredit stated: “We continue to be committed to providing ongoing support for the development of local businesses and economies through these initiatives in order to accelerate the COVID-19 recovery. This represents another concrete step towards ensuring cash flow continuity, especially for SMEs, which represent one of the key pillars of the economies of the Western Balkans, allowing them to finance working capital and investment programmes. At UniCredit, we work closely with our subsidiaries in all countries to make decisive and tangible actions in being part of the solution, ensuring continuity for both production and the supply chain in the economies of Eastern Europe.”

Feza Tan, Chairwoman of the Management Board and CEO of UniCredit Bank Serbia, said: “Our long-term successful partnership with the EIB expands with this new loan agreement. We are proud to continue working together with the EIB in supporting the local economy. Through both UniCredit Bank and UniCredit Leasing Serbia, we have so far utilised more than €95 million of EIB funding. We look forward to channelling these funds to local businesses. Being one of the leading banks in the market, we have the responsibility and strength to continue to actively support the recovery and development of the country.”

Mateja Norčič Štamcar, chargee d’affaires of the EU Delegation to Serbia said: “SMEs are the backbone of the economy and this is why we finance this area both in the form of grants but also through credits and credit guarantees. We are gladly partnering with the banking sector in this regard. All the EU’s efforts to support innovative and technology-oriented SMEs as well as other sectors these businesses work in will in the end serve the modernisation of Serbia and boost the economy, in particular, to help businesses affected by the COVID crisis.”

Increased access to finance for SMEs in the Western Balkans

The EIB has a well-established relationship with UniCredit, which has implemented several EIB credit lines to date, totalling more than €150 million for financing SMEs and mid-caps in Serbia and Bosnia and Herzegovina. The latest cooperation, signed in 2020, is a social impact loan for SMEs, established for the first time in Serbia. This innovative type of financing is designed for companies that make a positive impact on their community by providing employment and professional development to people from vulnerable social groups.