The real estate market, both here and in other countries, was exposed to various influences in the previous period. After the coronavirus pandemic, it was significantly impacted by the situation in Ukraine, as well as higher prices of construction materials and inflation.

The real estate market, which is also sensitive to global macroeconomic developments, perfectly reflects the economic situation in the country. In the past few years, it was significantly affected by the coronavirus pandemic, higher prices of construction materials and transport, as well as a lack of workforce, inflation, and the situation in Ukraine. Despite all that, the real estate market in Serbia is breaking records. Real estate, in addition to being a necessity, is increasingly becoming an investment in Serbia.

The total amount of money on the real estate market last year amounted to 6.1 billion euros, which is a 47% increase compared to 2020, according to the data collated by the State Geodetic Institute (RGZ). In the first quarter of this year, the total amount of money on the real estate market stood at 1.6 billion euros, which is a 22% increase relative to the first quarter of 2021, a record year so far. The number of sales contracts also went up by 6.7% if we compare the first quarter of this year and last year.

Apartments most in demand

In Serbia, real estate investments are the highest in the apartment segment. Logically, the volume of construction corresponds to sales figures, so the highest number of apartments is sold in Belgrade and Novi Sad. It is interesting to note that the Čajetina municipality ranks third in this respect. Last year, more apartments were sold in Zlatibor than in any other town in Serbia, excluding Belgrade and Novi Sad.

The vicinity of new office buildings, large shopping centres and other facilities which are considered useful for people’s lives can also lead to an increase in the price of apartments in a certain area

According to RGZ data, in the first quarter of this year, 32,164 sales contracts were concluded. All major cities in Serbia recorded growth in property sales if we compare the first quarter of this year and the previous year. In Belgrade, sales grew by 6.6%, Novi Sad by 13.7%, Niš by 20.5% and Kragujevac by 11.1%. The highest number of newly built apartments was sold in the Belgrade municipality of Savski Venac, where the Belgrade Waterfront is also located, which holds a record for the highest price per square metre of a newly built apartment.

According to data from the real estate advertising site 4zida.rs, the average advertised price of apartments in old buildings in Belgrade is 2,261 euros/m2, and 2,314 euros/m2 in new buildings. Realized sales prices are lower on average by around 20 to 30 percent, the cross-referenced data from RGZ and 4zida.rs show.

The real estate market in larger cities has been expanding, especially if we look at newly built apartments. However, this does not apply to all cities in Serbia. Smaller towns have been recording stagnation, and in some places, a drop in prices, especially of apartments in older buildings. In smaller towns, there is also less interest in new apartments, and consequently, there are fewer new buildings there. Last year, not a single new apartment was sold in Bor and Kikinda. We can conclude that, when talking about record prices per square metre or the number of realized sales contracts, we are primarily referring to business, university or tourist centres in Serbia.

Fluctuations in prices of square metres in Serbia

In larger cities, the high prices of a square metre of apartments in old and new buildings are primarily a result of high demand. All stakeholders on the real estate market testify that demand exceeds supply, and that good apartments are quickly sold. Also, the prices of apartments in older buildings are largely influenced by the price of apartments in new buildings. This is best noticed in the example of the Belgrade municipality of Savski Venac. In the last couple of years, during the construction of the Belgrade Waterfront development, Savski Venac became the record holder not only in terms of the price per square metre of apartments in new buildings but also for the prices per square metre of apartments in older buildings. In this regard, Savski Venac was ahead of the very centre of Belgrade – Stari Grad. New construction contributes to local development, and this, in turn, encourages apartment owners to raise the price of their apartments located in older buildings. The vicinity of new office buildings, large shopping centres and other facilities which are considered useful for people’s lives can also lead to an increase in the price of apartments in a certain area.

It has been estimated that the impact of macroeconomic developments will be felt more strongly in the second half of the year

The real estate market, both here and in other countries, was exposed to various influences in the previous period. After the coronavirus pandemic, it was significantly impacted by the situation in Ukraine, as well as higher prices of construction materials and inflation.

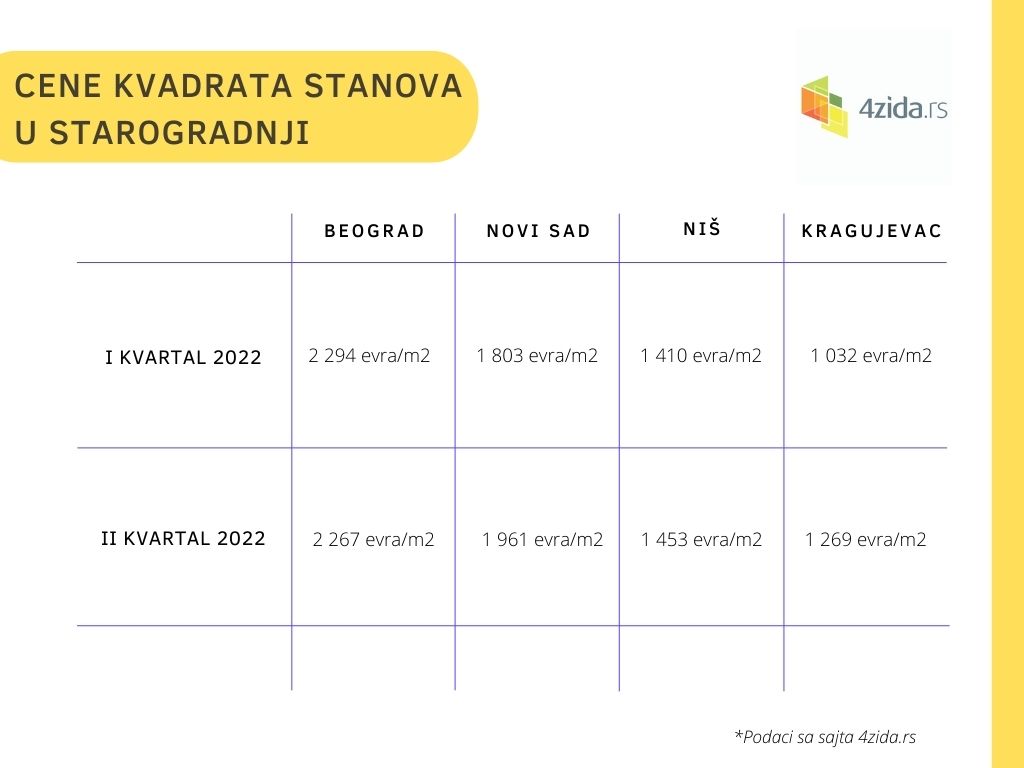

Nevertheless, in larger Serbian cities, there has been no significant drop in real estate prices so far. Thus, in Belgrade, in the first quarter of this year, the average advertised price of apartments in older buildings was 2,294 euros/m2, and in the second quarter, 2,267 euros/m2. In Novi Sad, the price per square metre of an apartment even recorded an increase, if we compare the first and second quarters of this year.

However, it has been estimated that the impact of macroeconomic developments will be felt more strongly in the second half of the year. Prices will be additionally affected by the eventual continuation of inflation, or potential major crises in the economies of more developed countries, on which our economy largely depends.

The impact of the situation in Ukraine on the Serbian real estate market

The situation in Ukraine is one of the factors that affected the real estate market in Serbia. However, it did not significantly affect the growth of purchase prices, as much as it affected the rental prices of apartments and the growth of demand, especially in Belgrade. Thus, studio apartments in the capital are rented on average for 221 euros, one-room apartments for 321 euros, two-room apartments for 552 euros, three-room apartments for 879 euros, and four-room apartments for 1,558 euros, according to data from 4zida.rs. These prices are even higher in the most popular Belgrade municipalities – Savski Venac, Stari Grad, Vračar and Novi Beograd.

In larger cities, the high prices of a square metre of apartments in old and new buildings are primarily a result of high demand

In late March, the 4zida.rs website conducted a survey to examine the impact of the situation in Ukraine on the real estate market in Serbia and how market stakeholders – buyers, tenants, property owners, real estate agencies and real estate developers – view the new situation.

The survey showed that the situation in Ukraine is of greatest concern to buyers who want to buy real estate with a help of a mortgage. They said that they had not completely given up on the purchase, but that they would further consider the type and conditions of a mortgage. It is estimated that their decision was additionally influenced by the recent increase in interest rates on housing loans, expressed in dinars and euros.

Data from RGZ show that housing loans are most often taken out for the purchase of apartments, and the share of properties that were paid for in this way amounts to 28%, if we look at the first quarter of this year. In the bigger cities in Serbia, apartments were mostly bought in Niš (40%), Novi Sad (33%), Belgrade (31%) and Kragujevac (25%).

The survey also showed that real estate agencies estimated that those buyers who buy real estate for their own needs delaying their purchase (due to anticipation of inflation) could potentially affect real estate prices, especially of apartments in older buildings, while the fear of real estate price increases can accelerate the purchase for those buyers who already have secured funds or are investment-oriented buyers. In the aforementioned survey, 15% of respondents stated that they buy real estate as an investment.

The research additionally showed that a different price trend is expected for apartments in older and new buildings and that these two markets cannot be viewed collectively. However, while in the case of apartments in older buildings, uncertainty about housing loans and inflation can lead to stagnation or a drop in prices, in the case of newly built apartments, other factors can most likely influence the price such as the shortage and increase in the price of construction materials, the increase in the logistics and transport costs and lack of a construction workforce.

The second part of the year will bring clearer forecasts regarding price trends for both older and new apartments. What we can currently conclude about the domestic real estate market is that in previous, turbulent periods, it showed significant flexibility, especially in those municipalities where real estate demand has been high.