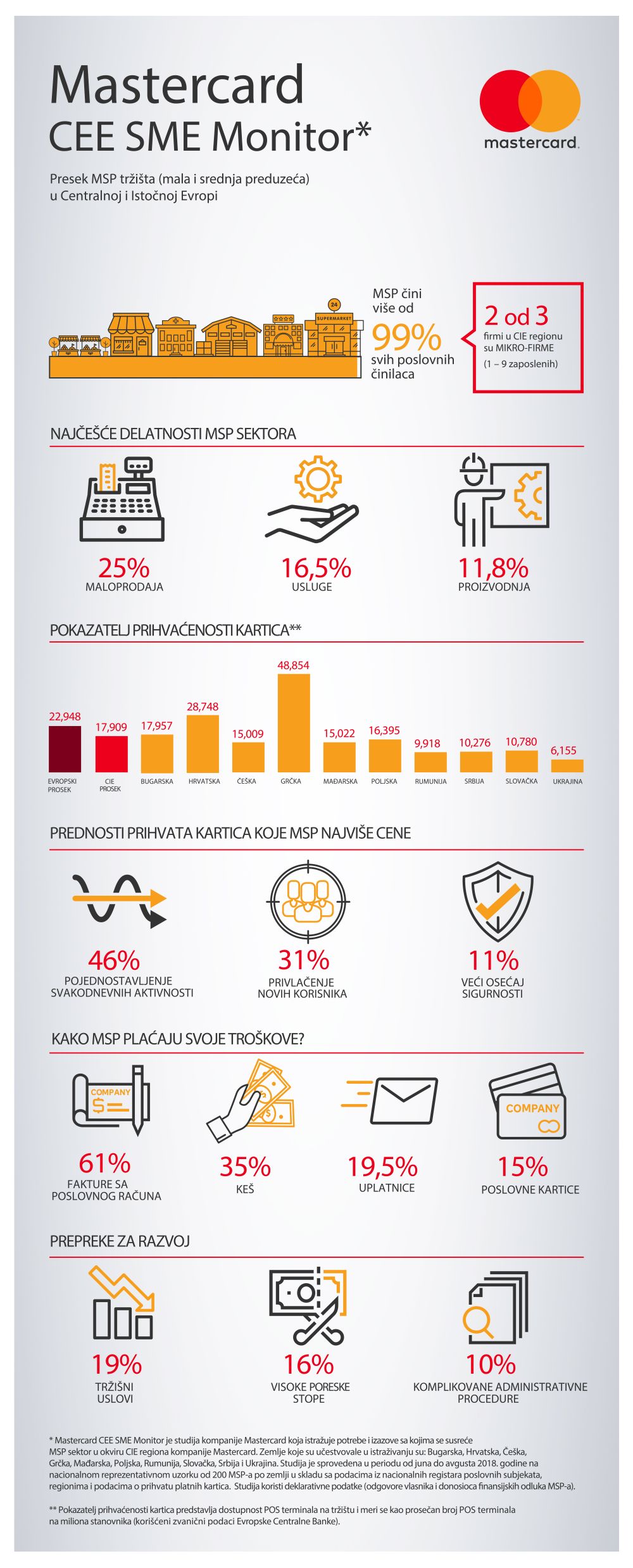

1 in 3 small and medium merchants (SMEs) in Central Eastern Europe enable card payments as a response to strong customer demand, while 18% of them see card acceptance as an opportunity to make their business stay in line with the modern technological trends. These are the findings of the Mastercard CEE SME Monitor study*, which also revealed that despite the uptake of Information and Communications Technologies (ICT) in both the relevance and its projected impact on society, SMEs in CEE mostly populate the traditional, non-ICT areas. A fourth of businesses operate in retail, followed by those in services (16.5%) and manufacture (11.8%). Serbia is similar to the broader region as 29.5% of local SMEs operate in retail, 22% are in manufacturing, and 20.5% in services. Interestingly, although Serbian ICT sector is seeing exponential growth in the number of businesses and employees and profit volume, only 2.5% of SMEs are ICT-related.

SMEs comprise over 99% of business sector in all CEE countries. Almost 2 in 3 businesses in CEE are micro businesses (1 – 9 employees), and their prevalence peaks in Hungary (69% of all SMEs), whereas entrepreneurship and self-employment is most prominent in Serbia (30.5%).

Official data show that in Serbia there are 10,276 POS terminals per million citizens, which is significantly below the CEE average of 17,909 POS terminals, which shows that it is still necessary to work on extending the cashless acceptance network. One in three respondents (34%) stated that they received their POS terminal free of charge from their bank and that they pay monthly fee corresponding to the monthly turnover, which is at the same time the most common way of cooperation between SME sector and banks.

The Monitor showed that SMEs recognize instore card acceptance as beneficial as it simplifies everyday operations (40%), helps attract new customers (35%), and provides a higher sense of security (13%). Moreover, it seems that SMEs throughout the region recognize electronic payments as a natural match to their online business too due to the convenience (54%) and growth potential (23%). In addition to that is the result of survey that 46% of payment in online shops of merchants who enabled electronic payments are made with payment cards, 31% via e-banking services, while only 15% of payment is done with cash when delivery.

Jelena Ristić, Country Manager for Serbia, Montenegro and Bosnia and Herzegovina, Mastercard commented: “Merchants understand that in order to stay competitive, they need to move in the same direction as their digitally-savvy customers. The gap between where merchants are and where they need to be can be bridged by payment industry taking a leap to modern payment technologies as a relevant, cost-efficient and secure mechanism to ensure payments are made – and received – anytime and anywhere.

Market conditions and high taxes hinder cashless development in Serbia

The CEE SME Monitor also looked into the general way in which SMEs handle their business expenses and across the region, payments from business bank accounts see the highest usage whether it comes to settling bills with suppliers, paying taxes or handling operational costs, scoring the CEE average of 57.9%.

Cash payments are also prominent (35.7%), especially in Bulgaria and Greece. What is interesting is that cash is significantly less used when paying taxes (22.7%), indicating that the regulatory framework and obligations for electronic payments have a big role to play in the switch from cash to cashless.

The benefits of electronic payments for seamless business operations are well recognized among Serbian SMEs, as 65.7% of respondents manage their expenses via business bank accounts and 20.5% use corporate cards. Prevalence of cash usage is below the CEE average (29.5%) which is an encouraging signal for the growing transparency of financial flows in the country.

Finally, the CEE SME Monitor shows that it is primarily external factors that hinder further development. Market conditions, i.e. overall low purchase power of citizens, is the most commonly perceived negative factor (19%), followed by high taxes (16.07%), and complicated bureaucracy procedures (9.94%), whereas fewer than 4% struggle with access to additional funds. No different is the perception in Serbia as the local business struggle mostly with the market conditions (24.5%) and high taxes (16%), while 1 in 10 highlighted unfair competition and unfavourable trade regulations.

Given that these are primarily issues in the regulatory and macro-economic domain, it is important that there is an open dialogue between SMEs and other market stakeholders on overcoming these obstacles. Globally, Mastercard is well under way with the commitment to financially include 500 million consumers and 40 million merchants by 2020, so the global insights, expertise and experiences in the field of electronic and digital payment technologies are sure to be a valuable asset to the CEE governments and businesses on their route to building sustainable economic futures for themselves.

SMEs in CEE:

- 21% of SMEs in CEE are in the micro-business category (1 – 9 employees and with annual overturn of up to 2 mn EUR). The second most common SME type are entrepreneurs and self-employed persons (26.87%), followed by small businesses (10 – 19 employees, annual overturn 2 – 10 mn EUR) – 8.82% of CEE SMEs, and medium businesses (20 – 50 employees, 10 – 50 mn EUR) with 2.86%.

- In Poland, 34% business-related payments are done via cards and in Ukraine 23.5% of business-related payments are received on cards, whereas Greeks and Croats are most likely to use their personal cards for making and receiving business-related payments (19 and 21.5%, respectively).

- When making payments, SMEs typically use invoices from business accounts (60.92%), cash (34.85%), postal orders (19.52%) and corporate cards (14.59%).

- All Bulgarian SMEs perceive themselves as being fully financially included, while only 2 in 3 Greek SMEs say the same.