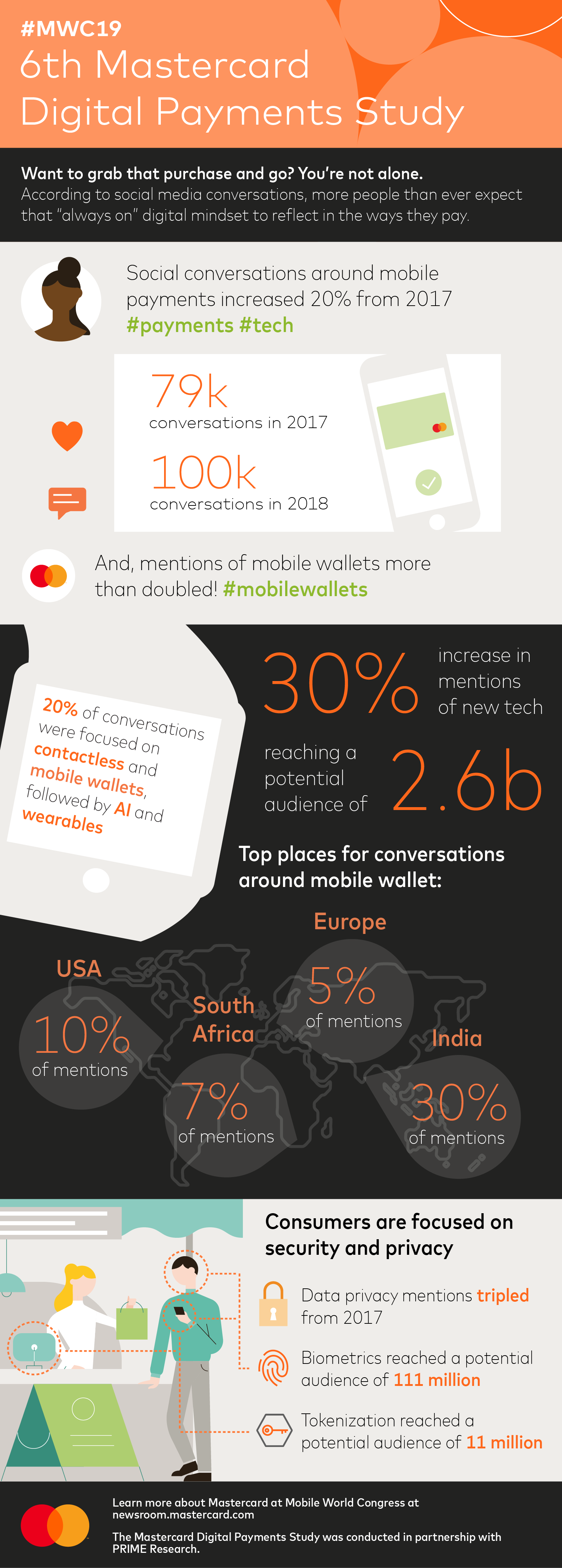

Do you want to take a coffee or take a shipment on the go? You are not alone. Today, more than ever before, people live in digital – and mobile – lives and expect to be able to pay for their needs in a way that coincides with their “always on” way of thinking – this is a conclusion derived from conversations on social networks presented within the Mastercard Digital Payments Study for 2019.

Mobile payments account for more than 27% of all conversations on social networks in connection with payments, with the number of their references increasing by 20% compared to the previous year. The mention of mobile wallets has more than doubled since 2018.

The Mastercard study has been conducted for six years and was developed in partnership with PRIME Research Agency, and the new release analyzed more than 3.3 million conversations over the past year on several social networks including Twitter, Facebook, Instagram and Veibo.

Interest in new technologies

People are looking for new technologies that would have an impact on their lives. In the past year alone, the reference to such technologies on social networks has increased by 30 percent compared to the previous study. Today, almost 20% of all mobile payment talks are focused on contactless payments and mobile wallets. In addition to these primary technologies, consumers are interested in how artificial intelligence, QR payments, and portable devices will affect their lives.

All in all, people have a positive attitude towards new technologies. Practically all conversations (95%) on mobile money were positive in the tone, and 30% emphasized the speed, efficiency and simplicity of the used products.

The adoption of mobile payments is visible in markets across Asia and Africa. India is a market with 30 percent of all references dominating online conversations on the use and potential of mobile wallets, especially in the area of public transport and the use of QR payments, specifically mentioning Masterpass and PaytmKR in India. The United States is second in terms of customer talk about mobile money (10 percent).

Discreet and ready for action

When it comes to analyzed conversations, it is clear that consumers continue to focus on the security of their money and protect their data as a basic requirement. In their announcements, people say they recognize the value of new technologies in securing the security of mobile payments.

When considering new technologies:

• The topic of biometric payments has reached potential 111 million people, primarily due to interest in voice payments and fingerprint scanners;

• Tokenisation and its key role in supporting and protecting payments of all kinds was involved in conversations that reached a potential audience of 11 million consumers.

Although the latest data on data abuse generated one-fifth of data-related conversations, another 13 percent of those talks pointed to the potential of digital security technologies, including blockchain, tokenization and biometrics.